How the Cash Discount Program Can Help Your Business Grow

COCARD has always been dedicated to empowering businesses through smart, cost-cutting payment solutions — and our new Cash Discount Program takes this even further. In this quick article, we are going to explore what the Cash Discount Program is, how it can save you money, and how it can keep your business resilient in these uncertain times.

What is the Cash Discount Program?

Leveraging our innovative technology, the Cash Discount Program lets you offset some or all your payment processing fees — so you can save more money and grow your business. This is accomplished by sharing fees with your customers who pay with credit cards, thus providing discounts for customers who choose to pay with cash. As a result, you get to keep more of your sales revenue — and your prices remain the same.

This automated process is compatible with guidelines from major credit cards like Visa and Mastercard, and it conforms with processing regulations. The Cash Discount Program is a great opportunity for businesses that want to put a bit more money in the bank — all while eliminating up to 100% of their monthly processing fees.

How Can the Cash Discount Program Help?

Business owners always strive to cut costs where they can, but in the tail-end of the COVID-19 pandemic, the need to save money has become much more serious. Facing an uncertain economic future, it has never been more important to adapt your business model to new circumstances (like to accommodate curbside service or online ordering) and to grow your savings so you can keep your doors open.

Our Cash Discount Program is a great way to keep more of your revenue, avoid crippling payment processing fees, and get the equipment you need to keep your offerings flexible for your customers. Better yet, to take advantage of this program, you don’t even have to make any changes to your menu, inventory, or pricing.

By encouraging your customers to pay with cash, you can avoid hundreds of dollars a month of processing fees — and you only pay a flat rate of $35 a month. At no extra expense, the Cash Discount Program also includes:

- Free equipment, including a wireless terminal option for takeout and curbside pick-up.

- Free setup for all your new equipment.

- Free signage encouraging your customers to pay with cash.

All of this for $35 a month, with no termination fee or contract. To make sure that there are no unnecessary hurdles stopping businesses from signing up for the program, the COCARD team is delaying all billing for 60 days. That means you get two months of service and savings without having to pay a dime.

Empowering Businesses to Excel

By signing up for the Cash Discount Program, businesses can get new equipment, save money on processing fees, and keep more of their revenue. But the Cash Discount Program is just one of many great payment solutions that we offer. COCARD gives you the flexibility you need to streamline payments, management, reporting, and more.

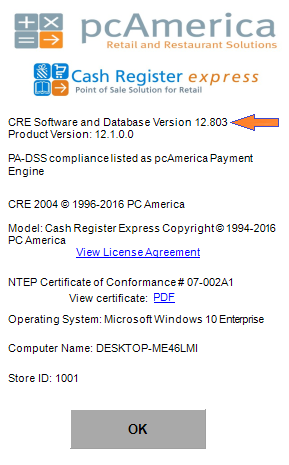

Using our innovative Revonu cloud-based point-of-sale technology, you can support online ordering, a top-end inventory management system, sales and employee dashboards, enterprise loyalty programs, consolidation reporting, and plenty more. Our payment solution also gives you the flexibility you need to manage your business no matter where you are. You can make changes to menu items, prices, descriptions, and promotions (and access all your business reports) from any computer or device.

We believe business owners should not have to waste time and money on inefficient payment processes and cumbersome dashboards. COCARD works for you, so you can spend more time doing what you love.

Read MoreRead More

According to an article by

According to an article by

There’s nothing worse than being busy and getting nothing done. If you ever find yourself in this predicament—actively standing still—we’d like to share four hacks to make your days more productive.

There’s nothing worse than being busy and getting nothing done. If you ever find yourself in this predicament—actively standing still—we’d like to share four hacks to make your days more productive.

It’s Friday – Friday – Friday!! TGIF !! Check out these tips for a great Friday, have a wonderful weekend!

It’s Friday – Friday – Friday!! TGIF !! Check out these tips for a great Friday, have a wonderful weekend!