Restaurant POS Systems – What is the difference?

This question was posed to me when I met with the owner of two Italian restaurants this past Friday. What is the difference in all of these systems now?

My response was “All of these systems, what do you mean?”

I learned first hand from a very savvy business owner that there are a lot of companies reaching out to him to offer him a POS System. I also learned that they were offering one single solution, be it a tablet or a traditional solution – and pushing what they offered hard.

None of the companies took the time to talk to this business owner about features, and features are what make the biggest difference.

These two restaurants needed reservation tracking, table clearing features, kitchen messaging, market price item setup, and much more. I learned this because I sat and asked to be taught about the business.

Twice this business owner has purchased solutions that were not a fit for his business.

I can tell you, that wont happen again. Now he will have a solution that does what his business needs, and nothing that it does not.

Would you like to talk about your business needs with me, and learn about the Restaurant Solutions my team has to offer?

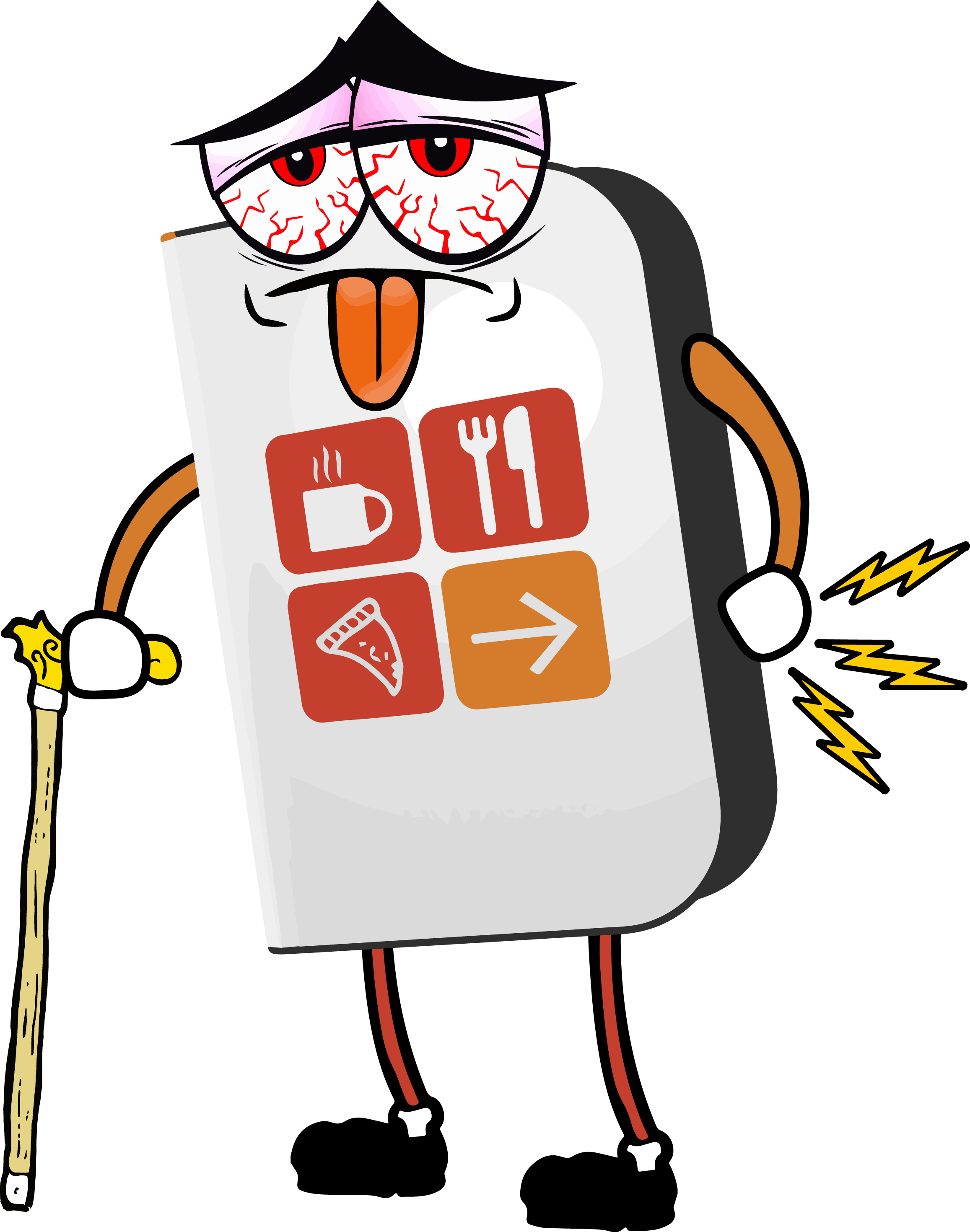

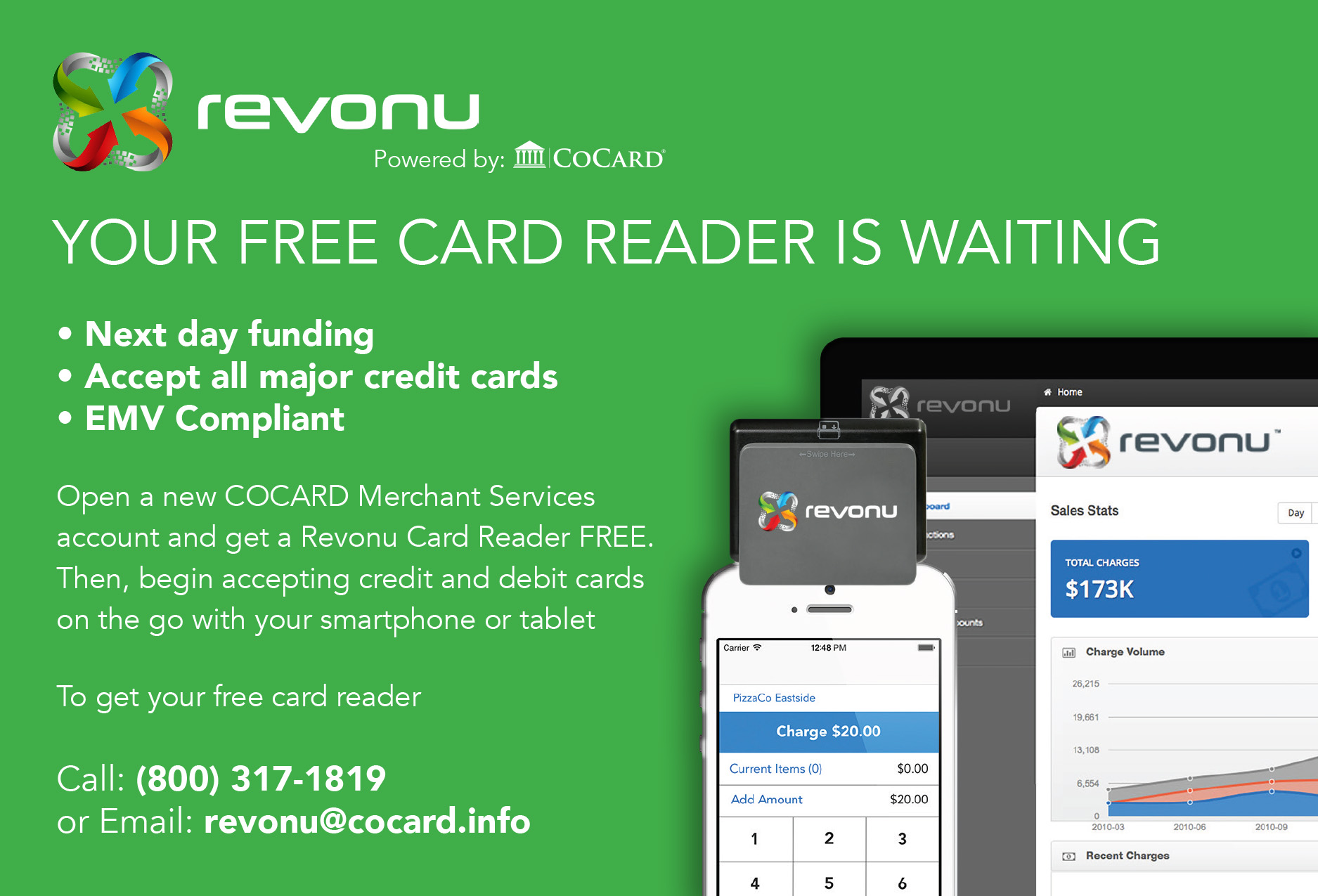

Read MoreRead MoreFREE POS Software For Your Business!

Yep, FREE! Give it a try or give us a call if you have questions, here is the link: http://cocard.info/sircle-pos/

Good-bye SunSet Software!

Sunsetting usually means that a product or software is no longer supported. Is the software you are using no longer getting updates with new features? If not, that usually means it is headed to the sunset!

Don’t keep buying software for your POS that is headed for retirement. Contact COCARD today and lets talk about how REVONU POS can give your point of sale new LIFE!

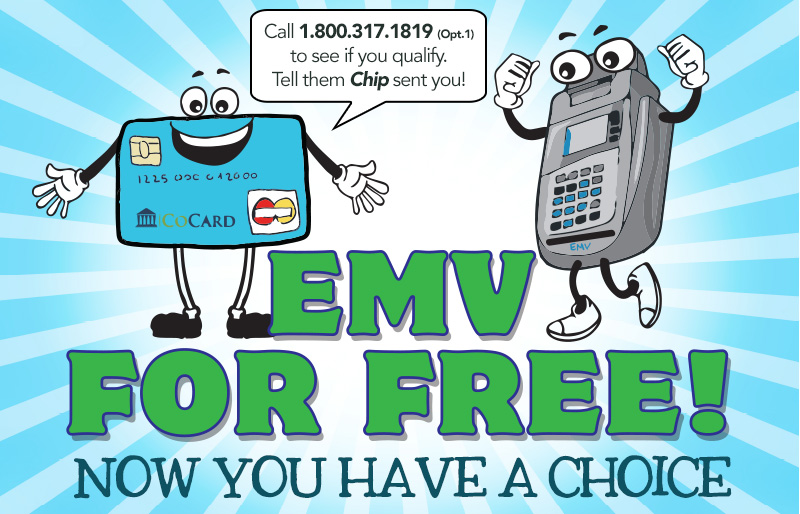

The First Year: Goals, Challenges, and Accomplishments with EMV

It has been little more than one year since the liability shift began on October 1st, 2015, where merchants would be liable for fraudulent activity in their stores, as opposed to credit card companies. And since then, small and large businesses alike have made the switch to EMV. Here is a look at some of what the transition has been able to accomplish, along with some of the challenges we continue to work through:

The Main Accomplishment: The main goal was to take a bite out of fraud, and so far, the switch to chip-enabled cards is doing just that. Mastercard, for example, in a press release last month, noted a 54% decrease in fraud between April 2015 and April 2016.

We do have a few areas where we continue to work on improving, and they include:

- During this transition, not all merchants use EMV-card processors. So sometimes you might be required to swipe, while other times you may need to insert the card chip-first. It can be confusing, but it is a necessary step to ease the transition.

- Speed of transactions. Some EMV payment processors are faster than others, and we want all of them to be quick, to get you in and out of a store swiftly. With different card brands having different speeds for payment processing, we would like to eventually develop a more streamlined, efficient payment speed that everyone works within.

- Bottlenecks. With many merchants deciding to upgrade to EMV-supported payment processors, certification can be a lengthy process, along with lead time needed to manufacture chip cards. Both can be a lengthy process, and Visa, for one, starting in July 2016, introduced initiatives to ease the certification process. And the card manufacturer, Oberthur, can manufacture cards in five days, cutting lead time significantly from the traditional weeks-long lead time.

Overall, we are making strides towards eliminating fraud in the United States, chiefly thanks to the merchants and consumers. We will continue to work on these items to ensure a better transition. To learn how COCARD can work with your company to ease the transition from stripe cards to chip-enabled cards, call us today at 1-800-317-1819.

Read MoreRead More