The First Year: Goals, Challenges, and Accomplishments with EMV

It has been little more than one year since the liability shift began on October 1st, 2015, where merchants would be liable for fraudulent activity in their stores, as opposed to credit card companies. And since then, small and large businesses alike have made the switch to EMV. Here is a look at some of what the transition has been able to accomplish, along with some of the challenges we continue to work through:

The Main Accomplishment: The main goal was to take a bite out of fraud, and so far, the switch to chip-enabled cards is doing just that. Mastercard, for example, in a press release last month, noted a 54% decrease in fraud between April 2015 and April 2016.

We do have a few areas where we continue to work on improving, and they include:

- During this transition, not all merchants use EMV-card processors. So sometimes you might be required to swipe, while other times you may need to insert the card chip-first. It can be confusing, but it is a necessary step to ease the transition.

- Speed of transactions. Some EMV payment processors are faster than others, and we want all of them to be quick, to get you in and out of a store swiftly. With different card brands having different speeds for payment processing, we would like to eventually develop a more streamlined, efficient payment speed that everyone works within.

- Bottlenecks. With many merchants deciding to upgrade to EMV-supported payment processors, certification can be a lengthy process, along with lead time needed to manufacture chip cards. Both can be a lengthy process, and Visa, for one, starting in July 2016, introduced initiatives to ease the certification process. And the card manufacturer, Oberthur, can manufacture cards in five days, cutting lead time significantly from the traditional weeks-long lead time.

Overall, we are making strides towards eliminating fraud in the United States, chiefly thanks to the merchants and consumers. We will continue to work on these items to ensure a better transition. To learn how COCARD can work with your company to ease the transition from stripe cards to chip-enabled cards, call us today at 1-800-317-1819.

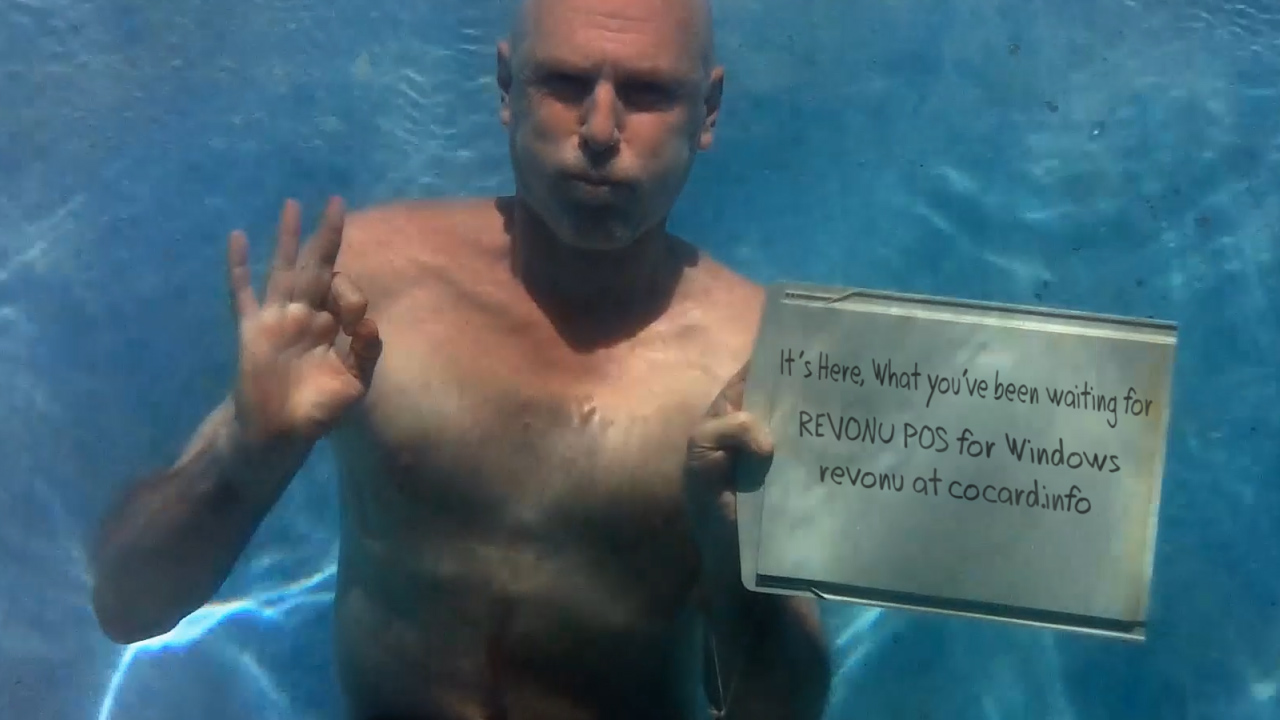

Read MoreRead MoreIt’s Here, What You’ve Been Waiting For; REVONU POS for Windows!

REVONU POS for Windows

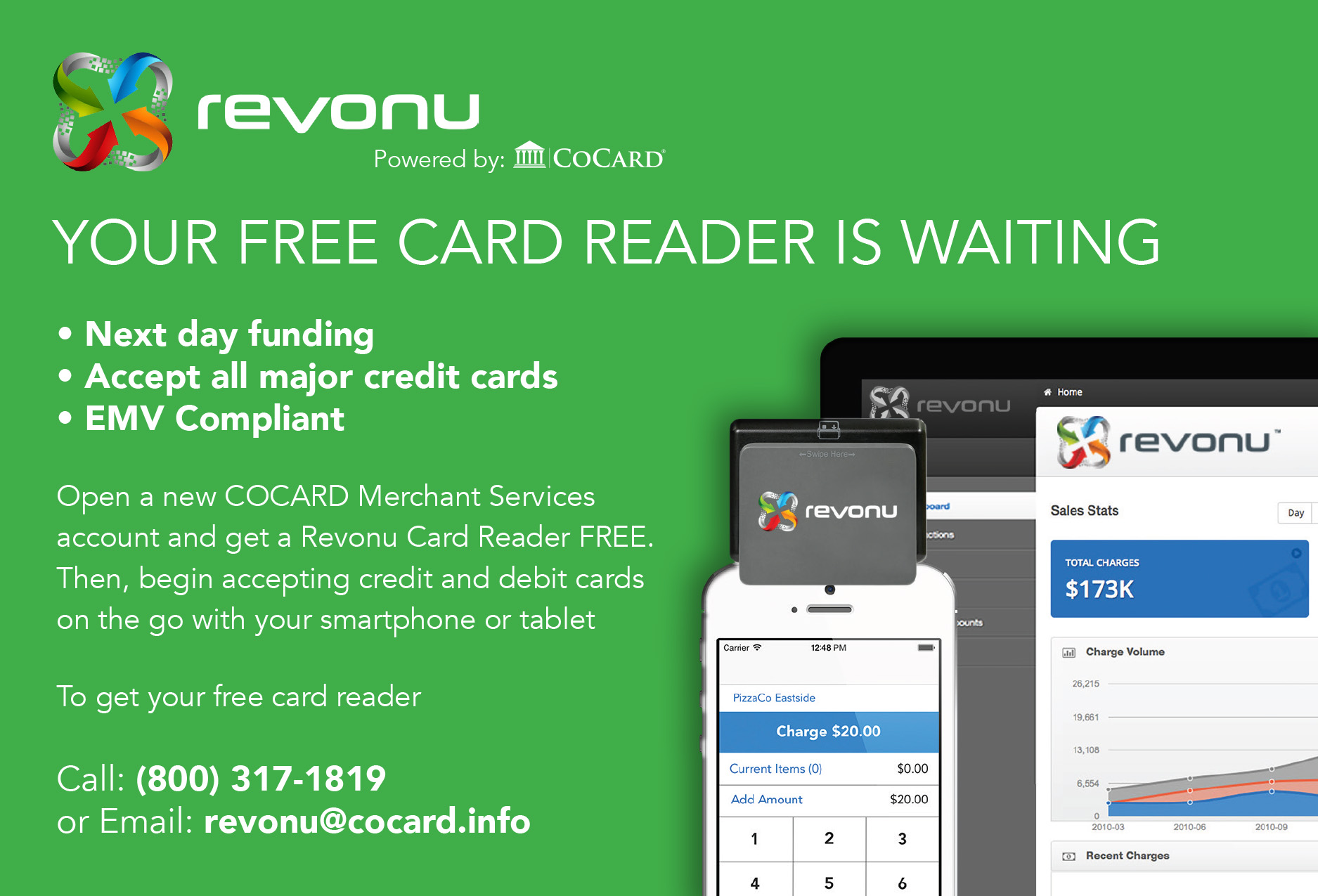

Why Should You Shift from Legacy to Tablet and Cloud POS?

As the information age has continued to create unprecedented breakthroughs in the tech industry, a number of products have become increasingly obsolete. Innovations in design, market strategy and consumer preference have all played a large role in the direction of best practices for both buyers and sellers of a number of technological goods. Prime examples of this are Point of Sale systems in the Merchant Service industry, which have gone through drastic changes from dial-up, stand-alone devices to web-integrated mobile solutions. As these changes have occurred, processing payments has become easier than ever, and it’s important for business owners to know how and why Tablet and Cloud POS systems are the better option moving forward.

For business owners, choosing a POS system that will run smoothly and reflect your method of business is as important as any other decision you make when setting up shop. Your POS system will be the operating location for every transaction you make with your customers, and being knowledgeable of the best tools available are key to your business’ growth.

Traditional, or “Legacy” POS systems are the original POS system, installed on-site at your business as a stationary device. The “on-site” method is a recurring theme with Legacy POS systems, which can prove to be problematic down the road for a business owner that is constantly on the go or seeking versatility. All maintenance is handled on location with Legacy POS systems, meaning repairs and installs must always be done during a scheduled time at your business location. POS configuration and set-up must also be done on site. Lastly, a number of gift and loyalty programs that customers seek must be purchased as separate software, which can prove to be expensive and time consuming to install. Overall, the Legacy POS system functions as an outdated tool for processing transactions and may hurt your business more than it helps.

Tablet and Cloud POS systems are a bit more flexible in their functionality, which is what makes them so attractive to business owners today. Many of these systems are obtainable through monthly payment plans, which can make them a bit more affordable for new business owners that may not be able to fork over a lump sum. Also, Tablet and Cloud POS systems have their software, data storage and analytics hosted via online servers (the cloud), which provide more security and convenience in the event that your POS system malfunctions or faces fraudulent activity. These solutions are also notably more accessible, with versatility as a mobile solution for business owners that may have moving businesses (such as food trucks, kiosks and vendors). You are also given the option to view your business data from any device with Internet access, so you can keep tabs on business activity even if you’re not there. In terms of maintenance, POS updates don’t necessarily require in-store activity.

With the wide range of Tablet and Cloud POS systems available in today’s market, it’s easier than ever for you to find a solution that fits your business needs. CoCard has a large inventory of solutions that can match exactly what you’re looking for. Don’t get left behind, call us today for more information about options that will allow you to process transactions more efficiently.

Read MoreRead MoreGoogle Bans Payday Lending Ads

MONEY!

In an interesting turn of events, Google announced on May 11 that it will no longer service online advertisements from Payday Lending companies starting July 13. This decision came due to increasing pressure (from civil liberties, consumer protection and consumer privacy groups) to make a change in advertising policy.

Many of these advocacy groups feel that Payday Lending services often target weaker consumers that are in poverty, forcing them to pay extremely high interest rates for short term money loans. Consumers frequently use these loans to cover expenses that they are unable to afford before their next paycheck comes. According to a report by Yahoo! Finance, a 2012 Pew study stated that “the average payday borrower is in debt for five months, spending $520 in fees and interest to repeatedly borrow $375.” Interest rates easily reach triple digit values, averaging around 391%. These high rates can generate billions of dollars in revenue for many of the larger Payday Lenders, which many feel is an unethical business practice.

Although many consumers are happy that Google is stepping in to combat these issues, a number of Payday Lending advocates, believe that this mandate is discriminatory, undermining the integrity of honest Payday Lending companies. In a statement recently obtained by the Washington Post, the Community Financial Services Association of America has stated “Facebook and others are making a blanket assessment about the payday lending industry rather than discerning the good actors from the bad actors. This is unfair toward those that are legal, licensed lenders.”

The Washington Post article also states that one of the more dangerous aspects of using the Google search to find a lender is the fact that extremely sensitive financial information can be gleaned by the search engine. Once a desperate consumer enters their personal information, consumers can be taken advantage of by ads designed to target their financial profile. The companies they find may not end up just being unethical — they are likely to be more expensive than using a brick and mortar lender due to online fees.

Despite Google blocking Payday Lender’s advertisements, consumers are still able to use the engine to search for lenders and investigate their websites. Although Google’s aggressive action will not completely mitigate the risks of using Payday Lenders, it will at least curtail the efforts of the less ethical ones.

Read MoreRead More

6 Ways Accepting Credit Cards Can Benefit Your Business

Are you wondering about the benefits of accepting credit cards for your business? Cash and check are acceptable forms of payment, but accepting credit cards adds the extra touch of legitimacy to your company. Take a look at the ways in which accepting credit cards can help your business.

- Accepting credit cards creates trust. When a potential customer sees logos of credit cards that your business accepts on an applique on your door, or noted on your website, your business becomes more legitimate because your business accepts trusted brands which are major forms of payment. The more that your business it trusted, the more likely someone is to buy from you.

- You will increase sales. Simply put, accepting credit cards will allow you to make more money because it’s one more form of payment that people are able to use to make a purchase. What business doesn’t want to increase sales?

- Credit cards offer convenience. Not everyone carries cash, and writing checks is fast becoming obsolete. However, most everyone has a credit or debit card. It is a form of payment that is carried by many people, and accepting it allows a person to make a purchase without the hassle of having to worry about using either cash or check.

- People are more willing to make a purchase with a credit card. People are more willing to buy on impulse using a credit card because of the amount of money on the line of credit.

- You can grow your business to include online sales. Online purchases generally require a credit or debit card to make a purchase. Accepting credit cards will allow you to conduct business online and, as #2 suggests, increase sales in the process.

- Payment snafus are eliminated. The beauty of a credit card is that it is declined immediately, so you don’t have to worry about your business losing money to a bounced check.

These are just a few ways in which accepting credit cards can make your business more profitable, and really, who doesn’t want that? Give COCARD a call today, we would love to help you find the perfect processing solution for your business! For more information about credit card processing, point of sale solutions and more call 1-800-317-1819 or email at info@cocard.info.

Read MoreRead More

Apple Pay Expands to Canada

If there wasn’t any before, Apple Pay’s recent expansion has given merchants throughout the country of Canada a strong incentive to provide point of sale solutions compatible with the service. Although Apple Pay isn’t necessarily a service that is new to Canada, May 2016 marks the first time that customers will be able to make transactions with cards not exclusive to American Express.

For those that aren’t familiar, Apple Pay is a relatively new mobile payment feature powered by Apple that allows customers to pay for goods and services through their iPhone, iPad, or Apple Watch. Launched in October 2014, the application is synced with a user’s credit card and is utilized by holding your device near the contactless reader on a merchant’s POS system. The application then requires a user’s fingerprint Touch ID to authorize the transaction, and is a replacement for traditional ‘Chip and Pin’ or ‘Chip and Signature’ security methods.

Although Apple Pay has been available in Canada since November 2015, it has only recently become available for merchants that process cardholders not affiliated with American Express.

On May 10, Apple Pay’s services were expanded to customers of Royal Bank of Canada, Canadian Imperial Bank of Commerce, ATB Financial and Canadian Tire Bank. This expansion now supports Visa, Mastercard, and Interac, servicing a majority of cardholders in Canada. Services will be further expanded to TD Canada Trust, Scotiabank and the Bank of Montreal in order to fully accommodate Canada’s ‘Big 5’ banks, as well as two additional credit unions (iMore).

Apple Pay has potential to make a big splash in the Canadian market, primarily due to its cooperation with banking institutions. American Express is infamous for charging higher processing rates than its competitors, so Apple’s expansion beyond AmEx as sole proprietor of mobile transactions greatly increases its potential consumer base. In terms of customer protection, LoyaltyOne’s Senior Director of Research and Development believes that Apple Pay’s combination of security and branding are among its strongest selling points in foreign markets.

“Trust and security has remained a big issue with digital wallet adoption to-date, but studies show that consumers are more likely to adopt a mobile wallet platform and engage with the app if they trust a brand, and because banks are some of Canada’s most trusted brands, they are well-poised to get the most out of this digital trend,” says Berry. (MobileSyrup).

Having anticipated this major market shift, CoCard is fully equipped with a number of POS solutions that can quickly and efficiently service Apple Pay users in the United States. For more info about Apple Pay devices, call CoCard today at (800) 317-1819 or email at info@cocard.info.

Read MoreRead More